Welcome back to our Weekly Digest. We hope you and your family are safe and doing well. Read on for this week’s update.

$800m Digital Business Plan to Drive Economic Recovery

The Australian Government has announced a Digital Business plan to enable businesses to take advantage of digital technologies to grow their businesses and create jobs in the wake of COVID-19. PM Scott Morrison and Treasurer Josh Frydenberg announced the almost $800 million scheme on Tuesday that will facilitate doing more business online in a post-pandemic world.

Under the plan, the rollout of Australia’s 5G network will be accelerated, the digital capacity of the agriculture, manufacturing, mining, logistics and financial services will be boosted, and Australians will be able to start a new business in 15 minutes using online government services.

If you need our expert advice on how you can start a business or pivot to adapt to the crisis, don’t hesitate to message us.

Victorian Government Accelerates Lifting of COVID-19 Restrictions for Melbourne

Melbourne’s nighttime curfew ends on Monday and COVID-19 restrictions may ease faster than expected, says Victorian Premier Daniel Andrew. This means the state could take its next step towards lifting restrictions as early as 19 October and achieve a potential “Covid-normal Christmas”.

Aside from 127,000 workers returning to various industries, including supermarket, food distribution, food processing, and manufacturing, primary school students can return to schools in the week starting 12 October. Childcare centres can open for all children, and visitors will be allowed in healthcare facilities and hospitals.

Furthermore, public gatherings of people from the same household or a limit of five people from no more than two households will be permitted. Outdoor exercises and activities such as fishing and hiking that don’t involve visiting a facility will also be allowed for a maximum of 2 hours within 5km from home.

We are thinking of everyone doing it tough at this time. Please don’t hesitate to reach out if you’d like to discuss future plans for your business.

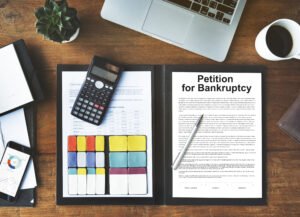

Major Overhaul to Bankruptcy Laws

After the major changes to the JobSeeker and JobKeeper programs, Australia’s bankruptcy laws have been overhauled, throwing a lifeline to struggling businesses amid the COVID-19 crisis.

Under the proposed changes, businesses with liabilities of less than $1 million will be able to keep operating while they come up with a debt restructuring plan, rather than be placed in the hands of administrators.

The new rules which will become effective from 1 January 2021 follows the government’s decision earlier this month to extend its temporary insolvency and bankruptcy protection rules until the end of 2020.

Supporting Apprentices and Trainees Wage Subsidy Extended

The Supporting Apprentices and Trainees wage subsidy has been expanded and extended to include medium-sized businesses who had an eligible apprentice in place from 1 July 2020.

Eligible employers will receive a wage subsidy of up to 50% of the wages paid until 31 March 2021 worth up to $7,000 per quarter, per eligible apprentice or trainee, to manage their cash flow challenges. Subsidies will also be available to any new employer who re-engages an eligible apprentice that was displaced by an eligible small- or medium-sized business.

This may be of particular interest to employers who are not eligible for the JobKeeper extension. For professional assistance in applying for this wage subsidy or any other funding assistance, feel free to contact us.

Business Resilience Package for Victorian Businesses

The Victorian government is investing $3 billion in cash grants, tax relief, and cashflow support to aid businesses hit by the tight restrictions and help them prepare for COVID Normal. The types of support included in this package are divided into three categories: Business Support, Business Adaptation, and Waivers and Deferrals.

Included in Business Support is the third round of the Business Support Fund for small- and medium-sized business ($822 million), with applications opening on 18 September 2020.

Meanwhile, Business Adaptation involves funding, tools, and resources to help businesses adapt to COVID Normal. Tax and cashflow support amounting to $1.8 billion will be provided by the government under the Waivers and Deferrals scheme.

For a detailed rundown of the inclusions of the Business Resilience Package, click here. Let us help you assess your eligibility and gain access to government support! Get in touch with us so we can schedule a consultation.

Sole Trader Support Fund

The Victorian Government has announced the Sole Trader Support Fund for eligible non-employing businesses affected by COVID-19 restrictions. Under this scheme, sole traders will receive a grant of $3,000.

Grant applications will open in the coming days and the full list of eligibility criteria will be published soon. We will keep you updated as soon as more information is available.

The JobKeeper scheme has now changed

The JobKeeper scheme has now changed and will now operate in two separate periods:

- Extension 1: 28 September 2020 to 3 January 2021

- Extension 2: 4 January 2021 to 28 March 2021

JobKeeper Extension 1

The tier 1 payment rate of $1,200 per fortnight applies to:

- Employees who worked for 80 hours or more in the four weeks of pay periods before either 1 March 2020 or 1 July 2020

- Eligible business participants who were actively engaged in the business for 80 hours or more in February and provide a declaration.

For any other eligible employees or business participants, the tier 2 payment rate of $750 per fortnight will apply.

JobKeeper Extension 2

For extension 2, payment rates will be further reduced to:

- $1,000 per fortnight for tier 1 employees and business participants

- $650 per fortnight for tier 2 employees and business participants

The ATO website provides further information about the eligibility requirements for the extension 2 period.

Decline in Turnover Test

Both these extension periods will require satisfaction of an additional actual decline in GST turnover test as follows.

Extension 1 (28/09/2020 – 03/01/2021)

September Quarter (Jul, Aug, Sept) relative to comparable period (usually same 2019 Q)

Extension 2 (03/01/2021 – 28/03/2021)

December Quarter (Oct, Nov, Dec) relative to comparable period (usually same 2019 Q)

For further details about the eligibility requirements for the JobKeeper extension 1, please refer to the ATO website, or ask us.

How does this differ from the original JobKeeper test?

- The decline in turnover must be demonstrated for specific quarters only.

- Rather than using projected GST turnover for the relevant quarter being tested, you use your current GST turnover.

- You must allocate sales to the relevant quarter in the same way you would report these sales to a BAS if you were registered for GST.

- If you are not registered for GST, you will work out your turnover using either the GST cash or non-cash basis of accounting.

What you need to do

From 28 September 2020, you are required to:

- Determine your eligibility for the JobKeeper Extension scheme using the actual turnover test for the September quarter

- Determine if you have any new eligible employees that were not previously nominated for JobKeeper and ask them to agree to be nominated

- Work out the Tier 1 or Tier 2 rate of pay that you will be claiming for each eligible employee/eligible business participant

- Notify your eligible employees which payment rate is applicable for them

- Ensure your eligible employees/eligible business participants receive the correct rate of payment per fortnight during each of the JobKeeper Extension periods according to the two tiers of payment

- If you are registered for GST and have outstanding BAS, you will need your BAS to be lodged for the September 2019 and December 2019 quarters now (or for equivalent months, if you report monthly) so that you don’t hold up your application for the JobKeeper Extension Scheme.

The ATO has a useful one page fact sheet outlining the key changes, but please ask us if you have a question.

How Small Businesses Can Source Finance During COVID-19

Although there are government funding schemes and support available, you might still need alternative finance to keep your business going.

If you are not sure where to turn for funding, consider these three sources of finance:

- External sources– This type of finance come from entities outside the business in the form of business loans, merchant cash advance, and invoice financing.

- Internal sources– This is sourcing funds from within the business, typically in the form of share capital and selling of assets.

- Personal sources– This means using your personal funds to finance certain elements of your business. This could mean using your personal savings and investments and selling your personal property.

If your small business is struggling due to the impacts of COVID-19, get in touch with us so we can help you assess your options and plan your business recovery.

Government-backed COVID-19 Loans Extended

The government is extending its small business COVID-19 loans scheme until June 2021. If you need help to access these loans or you want to find out if you are eligible, don’t hesitate to drop us a message.

Government Launches Business Continuity Website to Support Businesses Amid COVID-19

The Australian Government has launched the Australian Business Continuity website to support businesses with staff working remotely amid the pandemic.

The site provides free practical tools for remote communications, collaboration, workforce management, and video conferencing, as well as advice on how to best use teleworking services.

Get in touch

Contact us if you have any questions. S & H Tax Accountants can help your business get to the otherside of this pandemic.

[gravityform id=”3″ title=”true” description=”true”]