Starting a small business is both exciting and daunting. While the entrepreneurial spirit may drive you to take the leap of faith, the reality is that you may be entering a market that has already attracted some large competitors.

It can be intimidating to think about competing against larger, more established competitors, but it’s not impossible. Here are some steps you can take to help your small business take on larger, more established companies.

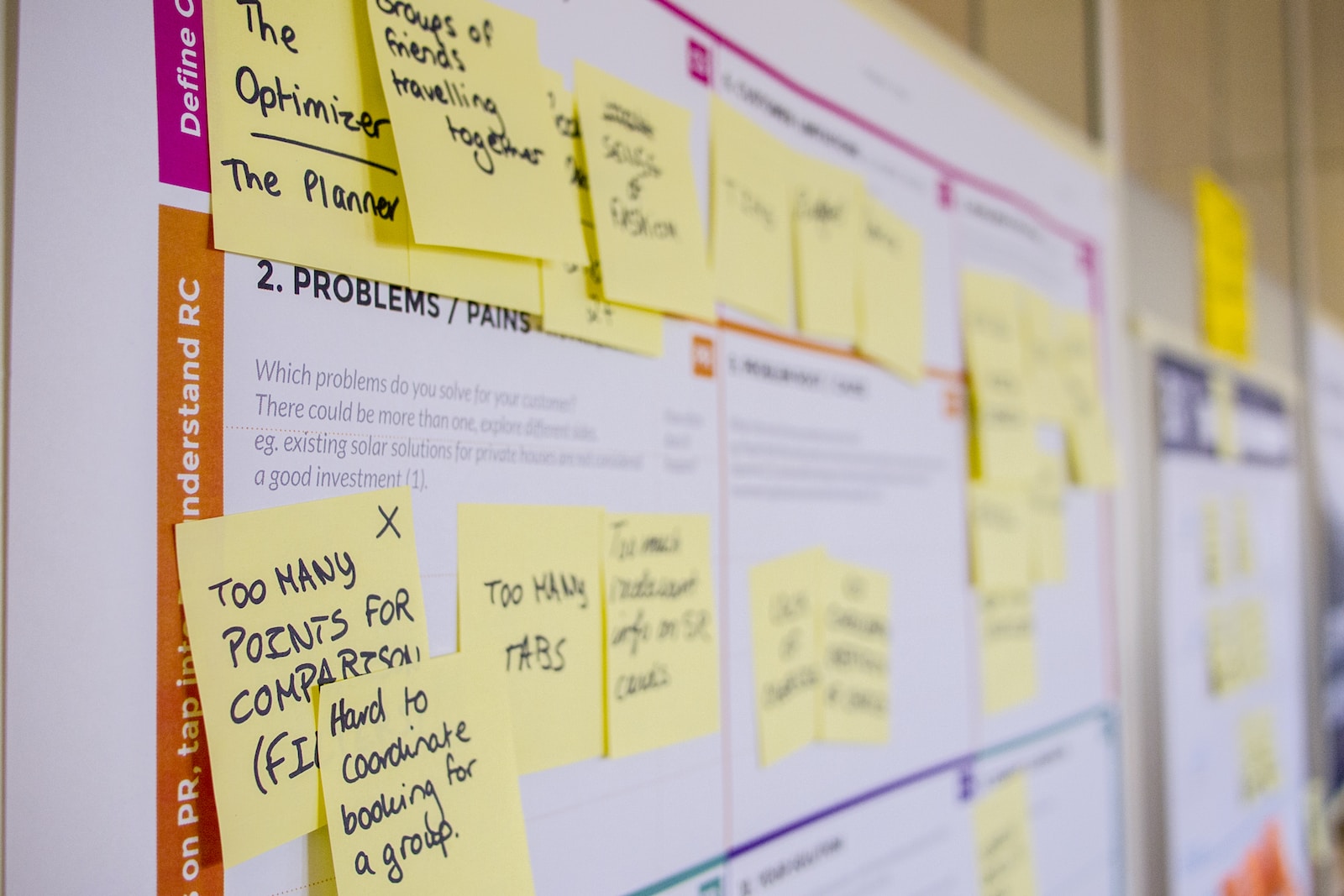

1. Identify your unique selling proposition (USP)

Your USP is what sets you apart from everyone else. That USP could be the quality of your product, your excellent customer service, your laser-like focus on one area of expertise, or your innovative approach to solving a problem.

When identifying your USP, ask yourself what it is that makes you different. Explore why you felt there was a need for your offering–what pain point are you solving that others aren’t already solving? Did you create this business because you noticed a gap in the market? Did you see a problem that didn’t yet have a solution?

Take time to identify what makes your business unique and use that to your advantage. Highlight your USP in your branding and marketing strategies.

2. Focus on your niche

One of the advantages of being a small business is you can be more niched than larger companies. Focus on a specific niche within your industry and become an expert in that area. By honing in on a particular area or pain point, you can create a loyal customer base that appreciates your expertise and the value you bring to the market.

3. Build strong relationships with your customers

As a small business owner, you have the opportunity to build personal relationships with your customers. Take the time to get to know your customers and their needs. Provide excellent customer service and go the extra mile to make them feel valued. Ask them what they’d like to see you offer, or how you can serve them better.

Clients and customers like the personal touch, and they appreciate feeling seen and understood. When you can have a one-on-one relationship with your customers, they’re more likely to stick with you.

4. Embrace technology

Technology can level the playing field for small businesses. You can use technology to automate processes, streamline operations, and reach customers online. Embrace social media and digital marketing to expand your reach and build your brand. Use tools like customer relationship management (CRM) software to manage your customer interactions and track your sales pipeline.

Technology isn’t just for the big companies. Anyone can use it to improve productivity and enhance the customer experience. By leveraging technology, you can compete with larger companies without breaking the bank.

5. Collaborate with other small businesses

Collaborating with other small businesses can help you reach a wider audience and gain credibility. Look for opportunities to work with businesses that complement your products or services. For example, if you run a boutique clothing store, you could collaborate with a local shoemaker to offer a bundled product. By working together, you can tap into each other’s customer base and create a mutually beneficial relationship.

6. Offer excellent value

Large companies may have more resources, but that doesn’t mean they always offer the best value. As a small business, you can provide excellent value by offering personal service, high-quality products, and competitive pricing. Make sure you price your products and services competitively while still maintaining profitability.

By offering excellent value, you can build a loyal customer base that will choose your business over larger competitors.

7. Stay nimble

A huge advantage of being a small business is your ability to pivot and adapt. You can make an adjustment in much less time than a large company can. Traditionally, large companies stay more focused on their traditional offerings, preferring not to experiment or make changes, which gives you an edge.

Stay nimble and be willing to adjust your strategy as needed. Keep an eye on market trends and be open to new opportunities. As you become more of an expert in your field you’ll be able to anticipate changes in the market.

Don’t be afraid to experiment and try new things. By staying nimble, you can stay ahead of the competition and adapt to changing market conditions.

By identifying your USP, focusing on your niche, building strong relationships with your customers, embracing technology, collaborating with other small businesses, offering excellent value, and staying nimble, you can take on the big players in your industry. Remember, success doesn’t happen overnight. It takes hard work, dedication, and a willingness to learn and adapt. Keep pushing forward, and you’ll get there.

We understand that it can be difficult to start-up a business, that is why we here at S & H Tax Accountants are here to help. Our accountants are well-qualified and experienced and thus, are able to give accurate advice and help their clients. We aim to provide the best possible service to our clients such as collaboration with small businesses and ways to make an excellent customer base. Book an appointment with S & H Tax Accountants call us at 03 8759 5532 or email us at info@sahtax.com.au.